Your nonprofit does what you need to do to keep the core of your finances compliant. You set an annual budget and fill out your Form 990 on time each year. But this is often not enough for nonprofit organizations to get the most from their finances. Are you even sure your Form 990 is correct? Do you review your budget on a regular basis?

Whether you need to take some simple steps to solidify your financial management approach or completely overhaul it, your organization will be able to accomplish more for your mission when you’ve fine-tuned your strategy.

In this guide, we’ll cover the core elements of healthy nonprofit financial management. To get started managing your finances, your nonprofit will have to:

- Craft your budget.

- Calculate your fundraising efficiency.

- Diversify your funding strategy.

- Determine your ability to take on risk.

- Contribute to your reserve fund.

Each of these tips was taken from Jitasa’s nonprofit financial management guide and is specifically targeted at growing nonprofits. Even if you have already implemented some of these tips, this guide will provide a deep dive into each strategy and offer tips to further fine-tune your own approach for continued growth.

1. Craft your budget.

Your annual budget should be a living document rather than one that’s simply compiled, presented to the board, and stuffed in a drawer. Many organizations are guilty of just that and don’t review their budgets on a regular basis.

Before you can review the budget, you need to create it and make sure that your financial estimates are as accurate as possible. Make sure you have an accurate view of your finances and how they can be used. That’s why you may have two different versions of your budget:

- Operating budget. This budget breaks down your organization’s revenue and expenses necessary to keep running smoothly. It shows you the financial information you’ll need to cover overhead expenses as well as to keep your programs running.

- Capital budget. Your capital budget takes into account long-term projects. For example, you might have an endowment fund gaining interest for a specific project or an ongoing capital campaign.

Considering these budgets separately takes into account some of the intricacies of nonprofit accounting like restricted funds. The last thing you want is to accidentally plan to spend money that you don’t actually have because it’s restricted or set aside for a specific purpose.

Failing to conduct reviews on a regular basis is one of the most common budget blunders that nonprofits run into. As a baseline, after your budget is completed, review your planned versus actual revenue and expenses with your team. Then, reevaluate your predictions on a semi-annual basis, making adjustments where necessary.

When it comes to growth, specifically focus on your capital budget and long-term projects. Growth is a long-term investment and may require a capacity-building campaign or another carefully planned growth initiative.

2. Calculate your fundraising efficiency.

You understand that it takes money to make money sometimes. That’s why you make investments in fundraising software, event venues, and marketing to promote your upcoming fundraising campaigns.

Many organizations calculate their return on investment per campaign, but a larger picture of your fundraising efficiency is immensely important when you consider expanding your organization.

That’s why we recommend calculating your overall fundraising efficiency ratio. You can find this metric with the following calculation:

Fundraising efficiency ratio = total fundraising revenue / total fundraising expenses

Calculating your ROI by campaign can help you understand how effective each campaign is. But calculating your entire fundraising efficiency ratio helps your organization understand how profitable you are as a whole.

Your result should be a positive number, otherwise, you’re actually losing money on your fundraising campaigns. If it’s coming close to zero, your fundraising is essentially a wash as you’re spending the same amount of money as you earn. The higher your ratio is, the more efficient and effective you are!

Review your fundraising efficiency ratio over the last several months and years. If your ratio is generally trending upward, it’s a good indicator that you might be ready for growth initiatives.

3. Diversify your funding strategy.

When the pandemic first hit, many organizations struggled to get their finances under control. One major challenge felt by nonprofits and for-profits alike was a lack of funding diversity. Let’s say a nonprofit relied on receiving a grant every year from the same company. But the pandemic caused that company financial stress so they couldn’t provide the grant that year. This nonprofit suddenly lost its main source of revenue!

Too many eggs in one financial basket can lead to instability if something suddenly causes that funding to disappear (like a global pandemic). Incorporating funding diversity into your development plan creates greater stability in your nonprofit’s revenue.

Therefore, consider the different revenue sources your organization currently has and how you might be able to expand those with additional fundraising ideas.

For example, you might receive funds from:

- Grants provided by companies and foundations

- Government support at the state, local, and federal levels

- Individual donations from your major donors

- Individual contributions from mid- and lower-tier supporters

- Interest earned on financial investments

But you can also get creative with your financial diversification. Double the Donation’s list of fundraising ideas lists new and interesting ways to increase your number of campaigns for individual contributions. But it also lists corporate giving opportunities to further diversify funding through volunteer grants and matching gifts, which are often overlooked funding opportunities.

4. Determine your ability to take on risk.

When your organization considers growth opportunities, there are some inherent financial risks associated. Let’s say you start a new program, but it isn’t the immediate success that you expected. You might need to eat some of the initial costs for the program until you’re able to get it running as effectively as you initially planned.

Therefore, your organization needs to be financially prepared to take on initial investments without displacing your other financial resources and activities.

You can measure your organization’s financial risk through your statement of financial position. This statement provides a snapshot of your organization’s financial health and you can base some important calculations based on the numbers in it.

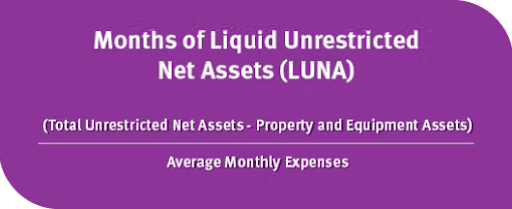

One of these calculations is your months of liquid unrestricted net assets (LUNA). The equation for this calculation is as follows:

Months of LUNA = (Total unrestricted net assets – Property and equipment assets) / Average monthly expenses

Here’s what you can gain from this calculation:

- When you have fewer than 0 months of LUNA, your organization doesn’t have the money on hand to cover your current expenses and needs to immediately cut costs or raise more.

- When you have between 0 and 3 months of LUNA, you may want to start thinking about ways to become more efficient, but it’s not a dire situation.

- When you have 3 months of LUNA, your organization is set up for success. This is what’s generally recommended for stability.

- When you have over 3 months of LUNA, your organization has a greater capacity to take on risk and growth initiatives.

Calculate your organization’s own months of LUNA to determine if you have the financial flexibility to take on additional risk. Then, you can adjust your nonprofit budget to incorporate your growth activities like hiring new staff members, starting a new project, or launching a capital campaign.

5. Contribute to your reserve fund.

In the last section, we discussed the months of LUNA as a way of calculating your organization’s ability to take on risk. The reason that months of LUNA make an accurate indicator of risk capacity is that it essentially measures your organization’s reserve fund.

Your reserve fund is the money that you have on hand in case of an emergency. For nonprofits, this should equal about 3 months of your expenses.

When you have more in your reserve fund, you are able to take on additional risk because you have that money to fall back on. Therefore, when your organization begins considering growth opportunities, the first thing you should do is consider how much funding is in your reserve fund currently and how you can add to it to build additional capacity.

If you have exactly 3 months of LUNA, consider ways that you can increase your revenue without drastically increasing your expenses in order to increase your organization’s reserve fund. Make sure these strategies are sustainable so you can maintain them and continue growing in the future.

Nonprofit finances can be challenging to understand. But, when your organization is considering opportunities for growth, you need to be able to understand your finances in order to see if you’re ready for growth. Then, take action to implement those growth strategies. Use the information in this guide to see if your organization is financially ready to continue growing.

ABOUT THE AUTHOR:

Jon Osterburg has spent the last nine years helping more than 100 nonprofits around the world with their finances as a leader at Jitasa, an accounting firm that offers bookkeeping and accounting services to not for profit organizations.